Free up funds with FlexPay!

Same debit card, more flexible payments

Looking to free up some funds?

Turn your BluPeak debit purchases into

installment payments.

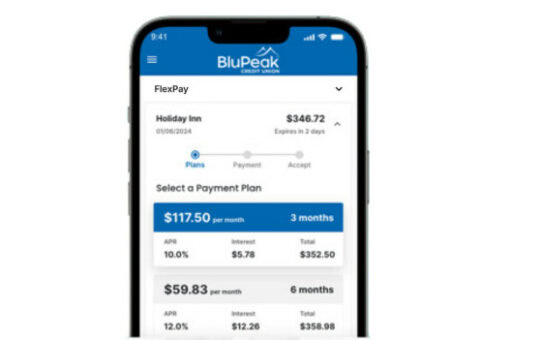

Say hello to BluPeak’s Buy Now Pay Later alternative, FlexPay! Now you will have the option to make a big purchase and spread the payments out over time.

Getting Started

-

Use your debit card whenever and wherever you shop.

-

Review and manage all plans, offers, and payments in one place.

-

Manage your budget by spreading larger expenses over time.

How it works

-

Make purchases with your debit card.

-

Check “FlexPay” in your online banking or mobile app.

-

View available FlexPay offers on eligible purchases.

-

Decide which purchases you would like to divide over time.

-

Select the installment plan that works for you.

-

See your purchase amount deposited back into your account in 24 hours.

Frequently Asked Questions

FlexPay offers can be found in online banking or mobile app.

If you do not see any FlexPay offers, this may be because your current account status or your recent debit card purchases are not eligible for FlexPay. If you already have active FlexPay plans, you may not be eligible for additional offers until the active plans are paid back.

An eligible purchase is a debit card purchase made in the past 60 days that is between $150-$1,800 and was not a cash equivalent purchase (e.g., ATM withdrawal, money order, cash advance, etc.). Other restrictions surrounding the merchant type and transaction limits may affect FlexPay eligibility.

No, BluPeak’s debit card FlexPay offering does not require a credit check.

Disclosures

Mobile data rates apply when using mobile banking. Must have an active BluPeak checking account with debit card (membership and account criteria apply) in good standing and open for at least 90 days. Not all checking accounts and/or debit card transactions will qualify. FlexPay is a loan product and offers are based on creditworthiness. You must receive an offer to use FlexPay. Offers will be extended for eligible in-store and online BluPeak debit card purchases in amounts between $150-$1800 for eligible accounts. Certain exclusions apply including ATM withdrawals, restaurants, taverns, nightclubs, gas stations, cash advances, loan payments, cash/cash equivalent or money transfer service transactions, purchases subject to foreign transaction fees, or transactions that involve any payment or fee owed to the Credit Union. Late fees apply, see the Schedule of Fees and Charges for more information about fees. Refer to the FlexPay offer in online banking for additional information, APR and term options.