BluPeak Credit Union

BluPeak is a full-service, federally insured, financially strong cooperative that is dedicated to building community, inspiring compassion, and being a conduit for positive change by supporting access to clean water as a means for bridging socioeconomic gaps and providing aid to those in need.

President & CEO

Thank you for being a Member of BluPeak.

We are a new and evolving kind of financial services firm choosing to prioritize our purpose over profits, helping employees live their best lives, and being committed to delivering extraordinary service and results for our members.

We are very proud to have introduced the BluPeak Foundation during late 2024. Going forward, this foundation galvanizes our commitment to making a positive impact in the communities we serve. The foundation’s inaugural donation was to Water.org, a global nonprofit working to provide families with lasting access to safe water. This was done as part of our annual celebration of “World Water Day”. Closer to home, BluPeak contributed a monetary donation to the Red Cross – enough to supply over 21,000 bottles of clean drinking water – helping bring vital relief to individuals and families affected by the California wildfires.

In addition, we have been providing solar roofs to thousands of homes across the country with our energy loan programs. We are proud to actively support community events such as San Diego Earth Fest, Davis Pride, and San Diego Pride, where we serve as sponsors and enthusiastic participants. These engagements not only reflect our commitment to diversity, inclusion, and environmental sustainability but also demonstrate our dedication to fostering vibrant and resilient communities. Through our ongoing involvement in such initiatives, BluPeak strives to contribute meaningfully to the well-being and vitality of the communities we call home.

2024 was a pivotal year for BluPeak Credit Union inside our multi-year commitment to transform ourselves from a 20th century traditional financial institution into a 21st century financial institution that is future-ready. BluPeak desires to be unlike any other financial institution you know. Our digital-first, purpose-focused strategy makes us different and is a strong long-term competitive advantage.

Being future-ready involves significant commitment to change with major investments in our digital transformation, while maintaining our high level of personal service. To ensure your money is safe, we invest in very strong cybersecurity measures and fraud detection systems. We live in complicated times where it is critical to support our members amid a continuously changing world.

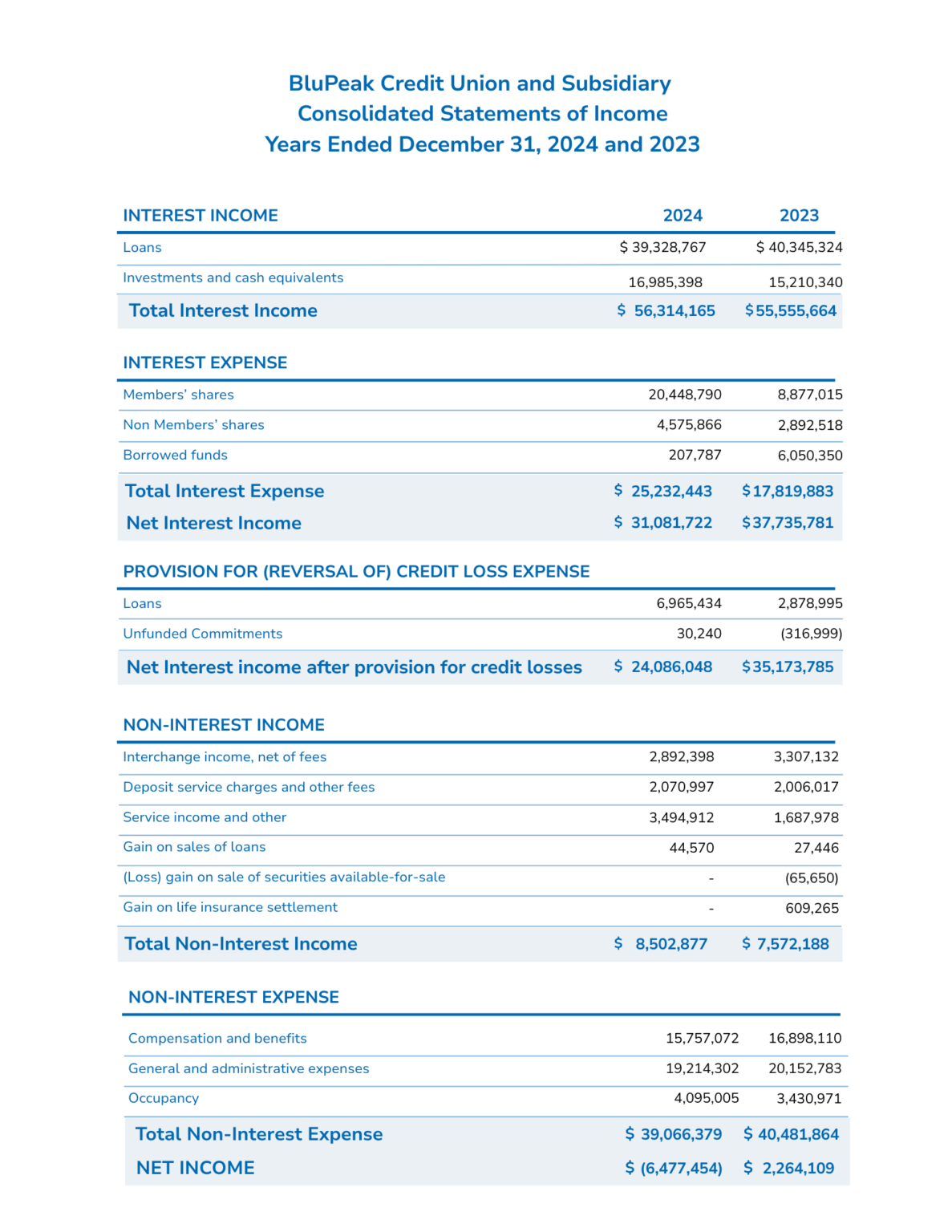

As we reflect on the past year, we acknowledge that it has been one of the most challenging periods in our credit union’s history. Economic uncertainties, and industry-wide financial pressures have tested our resilience. Despite these hurdles, our commitment to serving you—our members—has never wavered. Like many financial institutions, we faced unexpected difficulties that required difficult decisions. Our financial results in 2024 reflect our efforts to strengthen our long-term capital position, to support future growth. It was important for BluPeak to address COVID-era structural weaknesses remaining in our loan and investment portfolios. While these necessary actions impacted our financial results, we remain financially sound and dedicated to prudent management practices that ensure our long-term stability.

We want to express our deepest gratitude to you, our members, for your continued trust and loyalty. Your engagement and feedback remain invaluable as we navigate these uncertain times. We also extend our appreciation to our dedicated employees and volunteers who have worked tirelessly to uphold our mission.

Looking ahead, we are confident that the steps we have taken will position us as future-ready to support your financial needs and aspirations. Our strategic initiatives for the coming year include enhancing digital banking services, expanding our lending programs, and continuing to strengthen our financial foundation.

Thank you for being an essential part of our credit union family. We are committed to serving you with transparency, integrity, and unwavering dedication.

Sincerely,

Todd Tharp, Chief Executive Officer

Matt Adams, Board Chair

President & CEO

Chairperson, Board of Directors

Rich History

Our BluPeak Credit Union history spans over eight decades since our founding in 1936 as “California State Employees Credit Union #17″. Originally serving the financial needs of California state employees, BluPeak’s current membership base reflects its commitment to inclusivity and member-centric values.

Our rebranding to BluPeak in 2022 signified a strategic alignment with our California roots and innovative ethos, further shaping our approaches towards prioritizing member empowerment and technological advancement.

Purpose

At BluPeak, our purpose is clear: ensuring access to clean water is at the forefront of everything we do.

We also are committed to providing our members with essential financial services and regularly demonstrate this commitment by offering highly competitive rates to our members and ensuring that they receive maximum value from their financial partnerships with us.

We recognize the importance of adapting to the evolving needs of our members in an increasingly digital world. That’s why we’ve embraced a digital-first approach, offering innovative services such as live chat, artificial intelligence engagements, and mobile and online banking parity in features and functionalities. All of these digital strategies allow our members to conveniently connect with us from anywhere, at any time, ensuring seamless and personalized world-class service and assistance when they need it most.

By prioritizing access to clean water and continuously striving to enhance our services with cutting-edge technology, we aim to meet and exceed the expectations of our members, ensuring their financial well-being and contributing to a brighter future for all of us.

Your volunteer Board of Directors’ commitment, advice and leadership help make our Members’ lives better.

CHAIRPERSON, BOARD OF DIRECTORS

CHAIRPERSON, BOARD OF DIRECTORS

The Supervisory Committee provides the Membership with an independent appraisal of the safety and soundness of BluPeak Credit Union’s operations and activities.

CHAIRPERSON, SUPERVISORY COMMITTEE

CHAIRPERSON, SUPERVISORY COMMITTEE

The Leadership Team at BluPeak Credit Union oversees the operations and activities of the respective business units to ensure sound and efficient operations to provide our Members with exceptional level of service.

PRESIDENT & CEO

PRESIDENT & CEO

Chief Risk Officer

Chief People Officer

Chief Financial Officer

Chief Credit Officer

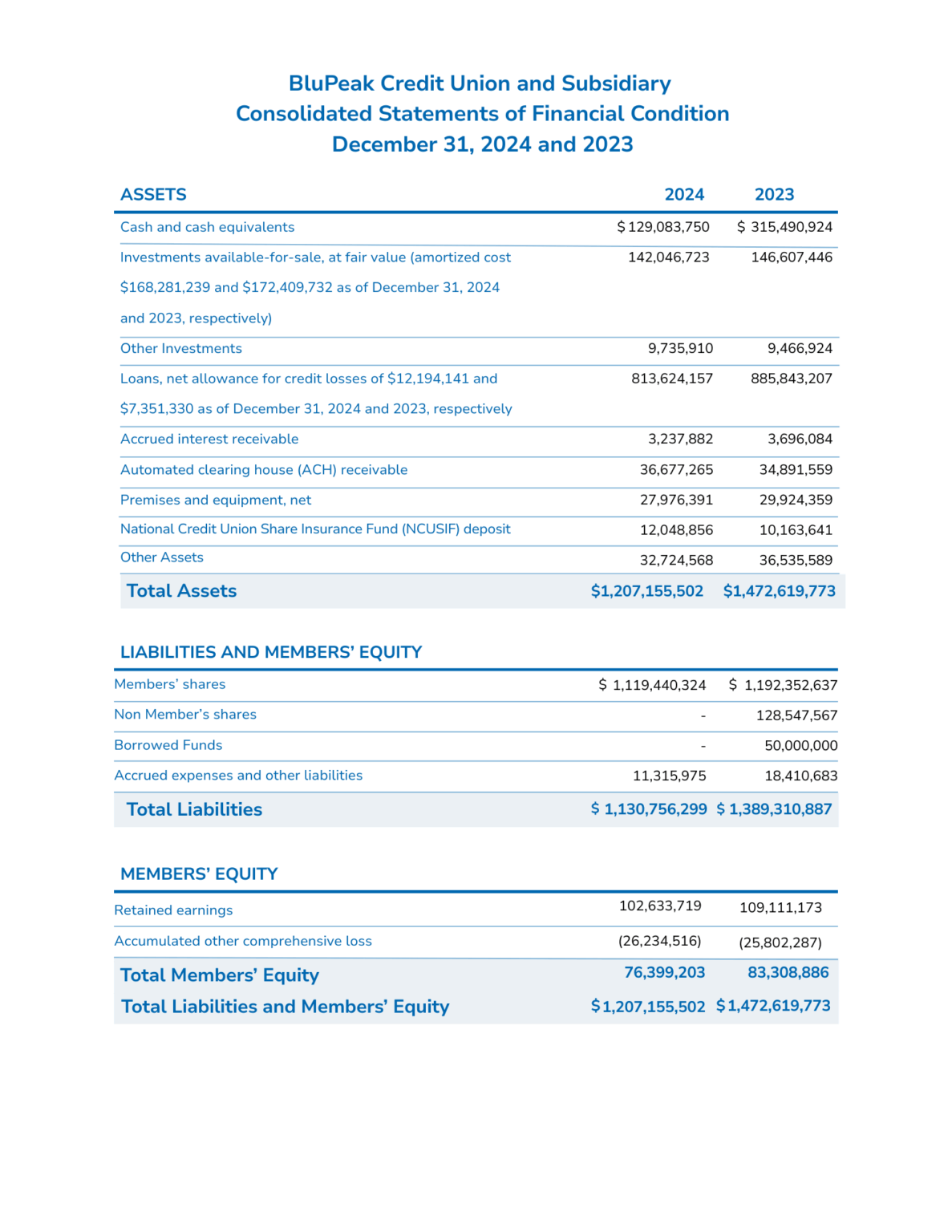

The Supervisory Committee provides the Membership with an independent appraisal of the safety and soundness of BluPeak Credit Union’s operations and activities. It does so in compliance with various financial and regulatory requirements.

In fulfilling these responsibilities, the Committee engaged Turner, Warren, Hwang & Conrad AC (TWHC) to perform the annual audit for the year ended December 31, 2024. TWHC issued its opinion that the Credit Union’s financial statements are presented fairly in all material respects.

In addition, the Committee held quarterly meetings to review, among other things, internal audit reports, internal controls and risk-management processes, and examinations by regulatory authorities.

In the opinion of the Committee, BluPeak Credit Union has operated in a financially sound manner and in accordance with applicable federal and state regulations. The Credit Union continues to be financially strong, and the assets of the Membership are being effectively safeguarded.

Annual Meeting of the Membership and Elections Announcement

Our Annual Meeting of the Membership will be held at 5:00 p.m., May 23, 2024 at the corporate office located at 10120 Pacific Heights Blvd #100, San Diego, CA 92121. Election of Volunteer Officials will be held during the meeting. The following have been nominated to serve three-year terms on the Board of Directors: Matt Adams, Yvonne Marsh and Michael Daniels. Steve St. Marie has been nominated to serve a three-year term on the Supervisory Committee.

We will also be voting on the following bylaw amendment, designed to mirror the minimum number of directors required by the California Financial Code: “The Board of Directors shall consist of an odd number of directors of not less than five (5) nine (9), and no more than eleven (11), each of whom shall be a member of this credit union in his or her own right and shall be a t least eighteen (18) years of age.”